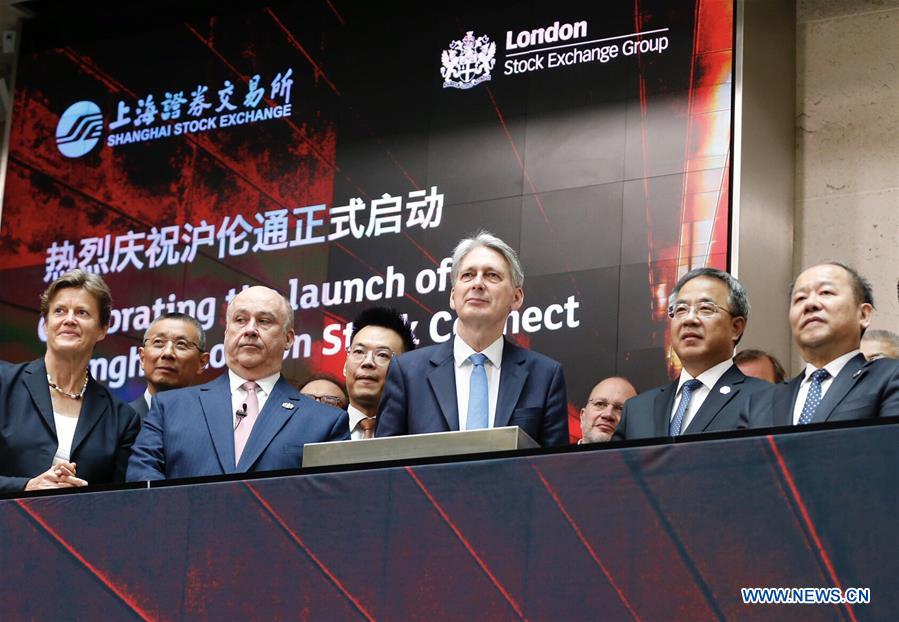

Chinese Vice Premier Hu Chunhua (2nd R, front) and British Chancellor of the Exchequer Philip Hammond (3rd R, front) attend the launch ceremony of Shanghai-London Stock Connect in London, Britain, June 17, 2019. The Shanghai-London Stock Connect program opened for trading Monday, a new step for China's financial market to further open up to the world. (Xinhua/Han Yan)

BEIJING, June 17 (Xinhua) -- The Shanghai-London Stock Connect program opened for trading Monday, a new step for China's financial market to further open up to the world.

As the first Chinese company to be listed in Britain via the long-awaited mechanism, the Nanjing-based Huatai Securities priced the Global Depositary Receipts (GDRs) issued at the London Stock Exchange at 20.5 U.S. dollars per unit.

The company planned to issue 75.01 million GDRs, with potentially more sales from an over-allotment, it said Saturday in a filing to the Shanghai Stock Exchange.

Zhou Yi, chairman and president at Huatai Securities, said the program enabled the first direct connection between the Chinese and European markets and offered the company an opportunity to enter one of the world's most mature and influential capital markets.

"The issuance of GDRs will further facilitate our development in international business and support us to expand our presence in the overseas market," Zhou said.

With the full exercise of the over-allotment, the listing would be the largest UK listing since 2016 and the largest UK GDR offering since 2012, according to J.P. Morgan, the joint global coordinator, joint bookrunner and sole stabilization agent on the Huatai Securities' listing.

Under the Shanghai-London Stock Connect mechanism, Shanghai-listed companies can list on the London Stock Exchange via GDR issuance, while British companies can issue China Depositary Receipts (CDRs) on the Shanghai Stock Exchange.

A quota system has also been established for the cross-border conversion business in the early stages of the program, according to a joint announcement by the CSRC and the Financial Conduct Authority.

Under the system, the quota for eastbound business is set at 250 billion yuan (about 36.26 billion U.S. dollars), while that for westbound business stands at 300 billion yuan.

The launch of the mechanism marks a crucial step in China's capital market opening-up and is a major part of the China-Britain pragmatic cooperation in the financial sector, the China Securities Regulatory Commission (CSRC) said.

The mechanism would be of far-reaching significance to expand channels for cross-border investment and fund-raising, boost the development of both countries' capital markets and encourage the building of Shanghai into an international financial hub, the CSRC said in a statement.

Calling the move a significant milestone for both China and the UK, J.P. Morgan said it would help expand A-share companies' fund-raising from overseas markets and provide international investors with new access to China's capital markets.

The Shanghai-London Stock Connect represents China's latest efforts in the opening-up of its capital markets. Similar stock connect schemes have linked the mainland stock markets with that of Hong Kong.

China has notably expanded access to foreign capital from brokerages, with dedication to promoting the internationalization of crude oil, iron ore and PTA in the futures market.

Meanwhile, global investors are becoming more and more optimistic about the outlook of the country's A-share market. Following Global index provider MSCI's move to increase index weighting for China A-shares, FTSE Russell is also planning to include A-shares in their global benchmarks.

China will soon unveil a series of measures to further open up the capital markets, according to Yi Huiman, chairman of the China Securities Regulatory Commission, at the recent Lujiazui Forum in Shanghai.

These will include amendments to the Qualified Foreign Institutional Investors (QFII) scheme and the yuan-denominated RQFII scheme to facilitate more overseas participation in the capital markets.

Vowing to ease restrictions on overseas banks' access to the securities investment fund custodian business and to further open up the futures market, the country will allow private equities by overseas fund managers to trade Hong Kong-listed stocks via the stock connect program and facilitate the issuance of yuan-denominated Panda bonds by overseas institutions, Yi said.

Besides, the country also plans to expand overseas institutional investors' access to the exchange bond market, he added.